Get This Report about Bagley Risk Management

Table of ContentsBagley Risk Management for BeginnersSee This Report about Bagley Risk ManagementLittle Known Facts About Bagley Risk Management.Little Known Facts About Bagley Risk Management.3 Easy Facts About Bagley Risk Management Described

In this manner, if rates do drop listed below that break-even point by the end day, policyholders are secured against a loss. This is very similar to the means barnyards run, though they use a conventional bush. Once a breeder agreements their cattle with a barnyard, they hedge those livestock to secure in the profit point.This will certainly be countered by the enhanced value of the livestock. The margin stays primarily the same. With LRP Insurance, breeders protect against a decrease in the futures board, yet don't lose on the higher return when prices rise. To say that livestock markets can be unstable is a little bit of an understatement.

They do this by picking a reduced percent of the predicted ending worth - Livestock insurance. This is a terrific strategy for those seeking lower premium rates or who have a higher risk tolerance because of strong financial wellness. This strategy may not protect earnings, however it can shield versus serious market declines

There is not a great deal of defense or coverage on a month-to-month basis, but if there is a significant crash, manufacturers have the comfort that comes from knowing they will only be in charge of a particular quantity out of pocket. Simply bear in mind, expect the very best but plan for the worst.

All about Bagley Risk Management

Feeder livestock can be covered up to a 900-pound expected end weight and fed cattle can be covered up to a 1,400-pound end weight. With a number of weight courses to pick from, it is possible to cover animals with the feedlot to the packer rail.

Applications can take numerous days to process and merely filling up one out does not secure the candidate into a plan. Once the application is authorized and all set, the LRP recommendation, with its end day and predicted ending worth, can be secured in quickly. This enables breeders to cover calf bones when the cost is right for their market danger administration goals.

Picture Politeness USDA-NRCS Prices for calves, feeder livestock and completed cattle have actually set some brand-new records this autumn and very early winter. A mix of circumstances has sped up these historical prices. There is currently a lot of careful optimism for cow-calf producers as they consider the future.

Bagley Risk Management Can Be Fun For Anyone

There are some advantages to manufacturers in using LRP insurance coverage as compared to a traditional feeder livestock contract or purchase of an alternative - Livestock risk protection insurance. One is the versatility in the variety of livestock that can be insured. There is no reduced limitation to the variety of livestock that can be guaranteed

There is no responsibility to market cattle on which you have actually bought LRP Feeder Cattle insurance coverage. You may pick to retain possession and still be qualified for the indemnity ought to the Actual End Value fall listed below your Coverage Price. You may market cattle covered by LRP any time, provided the transfer of ownership does not occur greater than 60 days prior to the LRP Agreement End Day.

If cattle perish and your Ag, Threat Expert is notified within 72 hours of you finding out of the fatality, the coverage remains effectively, and the manufacturer is qualified for indemnities because of cost loss, even on those pets which perished. Yes! Calves can now be covered before hooves struck the ground.

The Definitive Guide to Bagley Risk Management

Step 1) Full an application. Applications make sure novice consumers can be pre-approved to compose an LRP plan It is cost-free! Action 2) Lock in an Unique Coverage Endorsement (SCE) when you locate a quote that satisfies your goals. There are lots of levels of quotes that are launched daily making this a really versatile item that will fit any kind of producer.

We are below for you. Together, we're much better. Together, we'll secure your financial investment.

With the relentless variation and changability Read Full Report of the market, Livestock Danger Security (LRP) is something all livestock manufacturers should think about. The main function of LRP is to shield versus the unexpected downward price motion in the industry by establishing a base on any type of provided day and kind of livestock you desire to insure.

The Buzz on Bagley Risk Management

There are a range of insurance coverage degree alternatives ranging from 70 to 100 percent of the expected finishing worth (https://www.easel.ly/infographic/ganol3). At the end of the selected insurance coverage duration, if the real finishing worth is listed below the protection cost, you will certainly be paid an indemnity for the distinction in rate. Manufacturer expects to market 1,000 head of 11cwt cattle and selects coverage of $66

As of 2020, LRP (Cattle) is now available in all states when the market is readily available. 1. Feeder Livestock with finishing weights under 600lbs or 600lbs-900lbs, and 2. Fed Cattle with ending weights between 1,000lbs-1,400 pounds that will certainly be marketed for massacre near the end of the insurance coverage period. whereas livestock insurance coverage does.

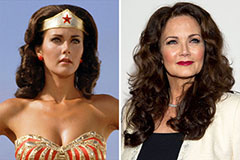

Lynda Carter Then & Now!

Lynda Carter Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Daryl Hannah Then & Now!

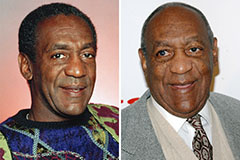

Daryl Hannah Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!